Debt Free Journal

So you’ve decided to break up with debt once and for all. Now comes the hard part, how do I actually get rid of my debt? Enter, Debt Free Journal!🚪

Put simply, Debt Free Journal was created to help you become Debt Free. Furthermore, this journal was designed to help bring clarity to where you financially stand today, help you define your debt and build an action plan to pay it off, and to create a healthy rhythm of intentionality with your personal finances to help you build a purposeful life.

Some of the biggest reasons people fail to pay off their debt is lack of planning, not sticking to a budget, losing steam from lack of accountability or not tracking and celebrating their progress as they pay off debt. I faced each of these pitfalls on my own Debt Free Journey and have seen friends and family run into the same roadblocks while trying to become Debt Free. That’s why I set out to create this journal. I want every person to take their absolute best shot at becoming Debt Free and experiencing the peace, flexibility and freedom that comes from living without Debt.

If you're ready to finally break up with debt and find financial freedom, Debt Free Journal can help you get there!

Highlights

Debt Free Journal was created to be your go-to tool on your Debt Free Journey and to help you with the following:

- Help you understand where your finances are today.

- Determine the debts you currently have, save an emergency fund and create a clear plan to become Debt Free.

- Build a new rhythm of intentionality with your finances and feel more in control of your own financial future.

- Experience financial freedom by becoming Debt Free.

Details

- Premium Satin Black Hardcover

- Copper Foil Stamped Exterior Logo

- Fold Flat Binding

- Black Ribbon Bookmarker

- 6.5" x 8" Format

- Proudly printed in North America

International

Our boutique, US-based shop ship s to dozens of countries globally. Here are some things to note.

- International customers are responsible for any custom/vat fees that occur when the product arrives in your country.

- Shipping time varies and can take 4-8 weeks depending on your country and their customs process.

- Shipping prices have been dramatically improved by offering new carrier options, but are still considerable for some. Consider bundling items or ordering with a friend to bring down shipping cost per item.

Bundle & Save

- Buy 2 or more for 10% with code BUNDLE2

- Buy 5 or more for 15% with code BUNDLE5

- Buy 10 or more for 20% with code BUNDLE10

- Buy 30 or more for 30% with code BUNDLE30

How It Works

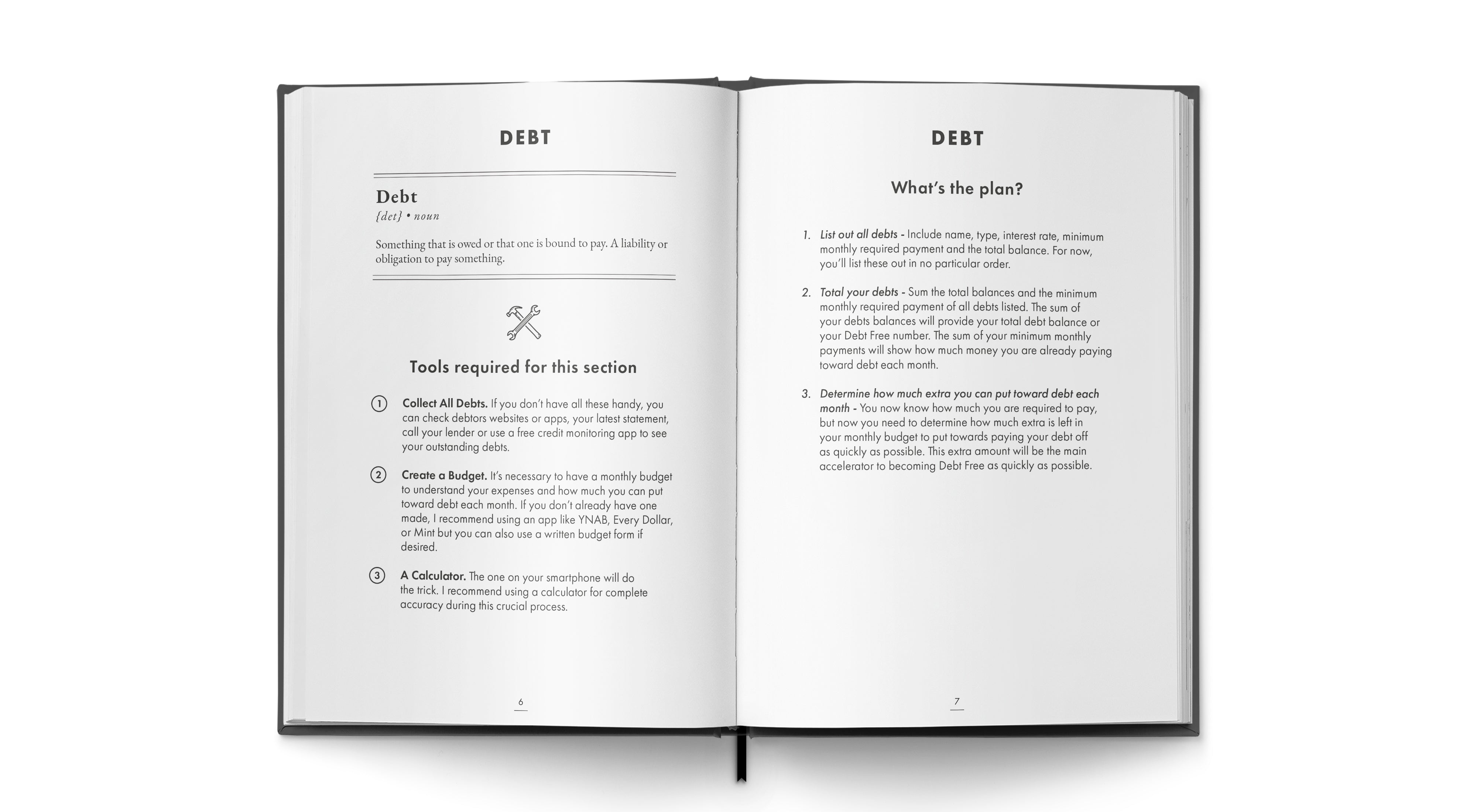

Getting Started - In the first section you'll establish your starting point by gathering information to establish a road map for your Debt Free Journey.

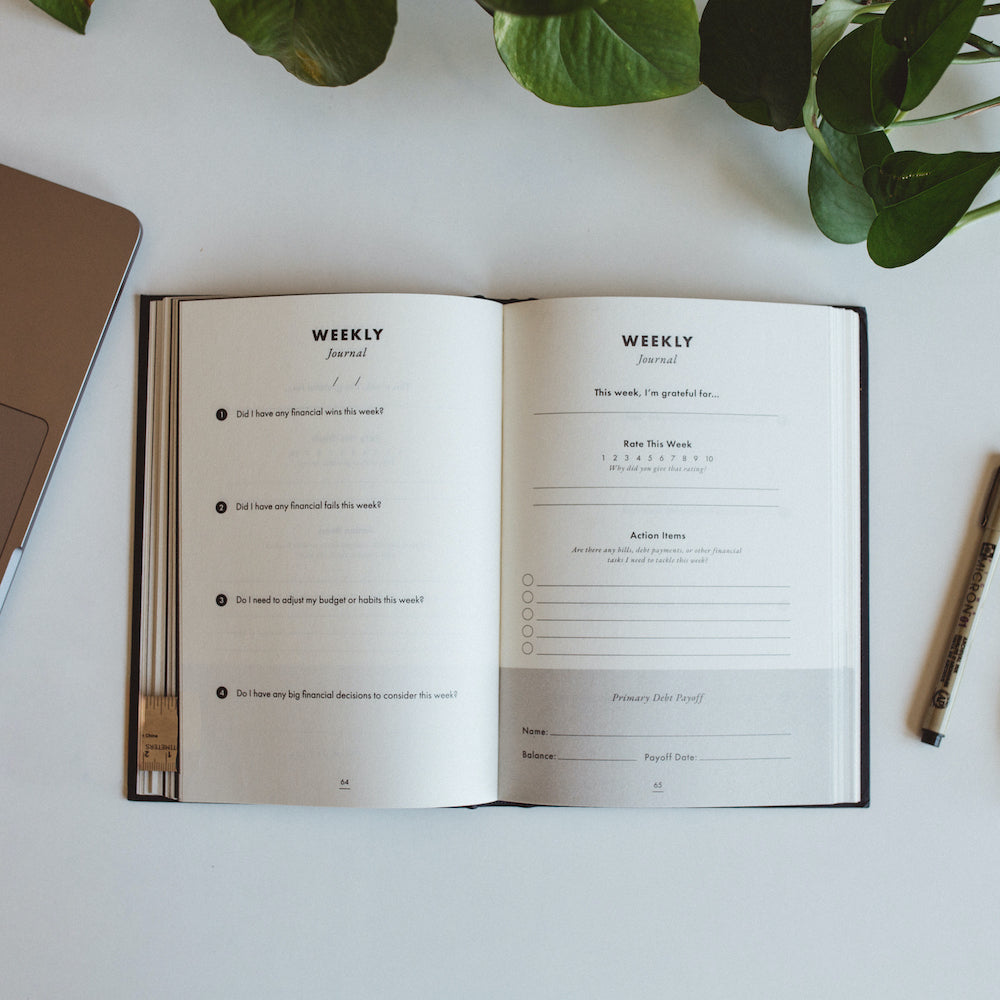

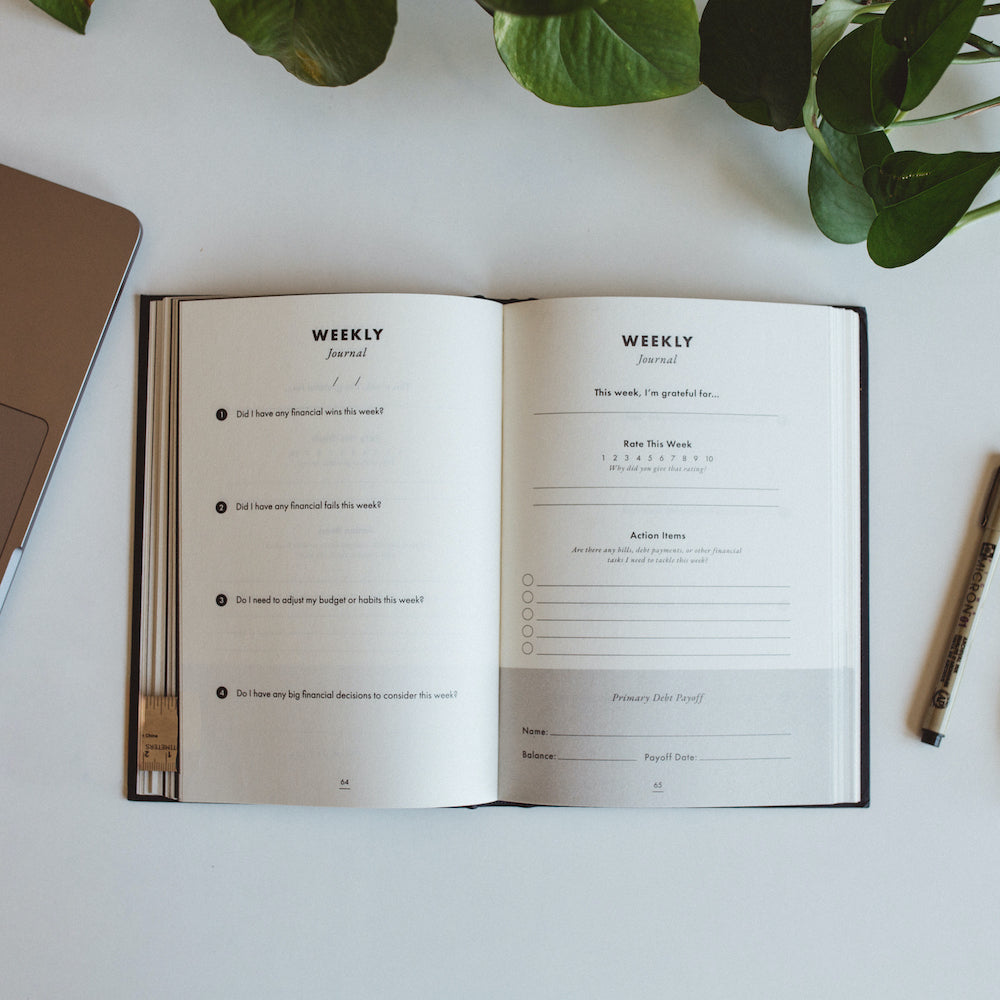

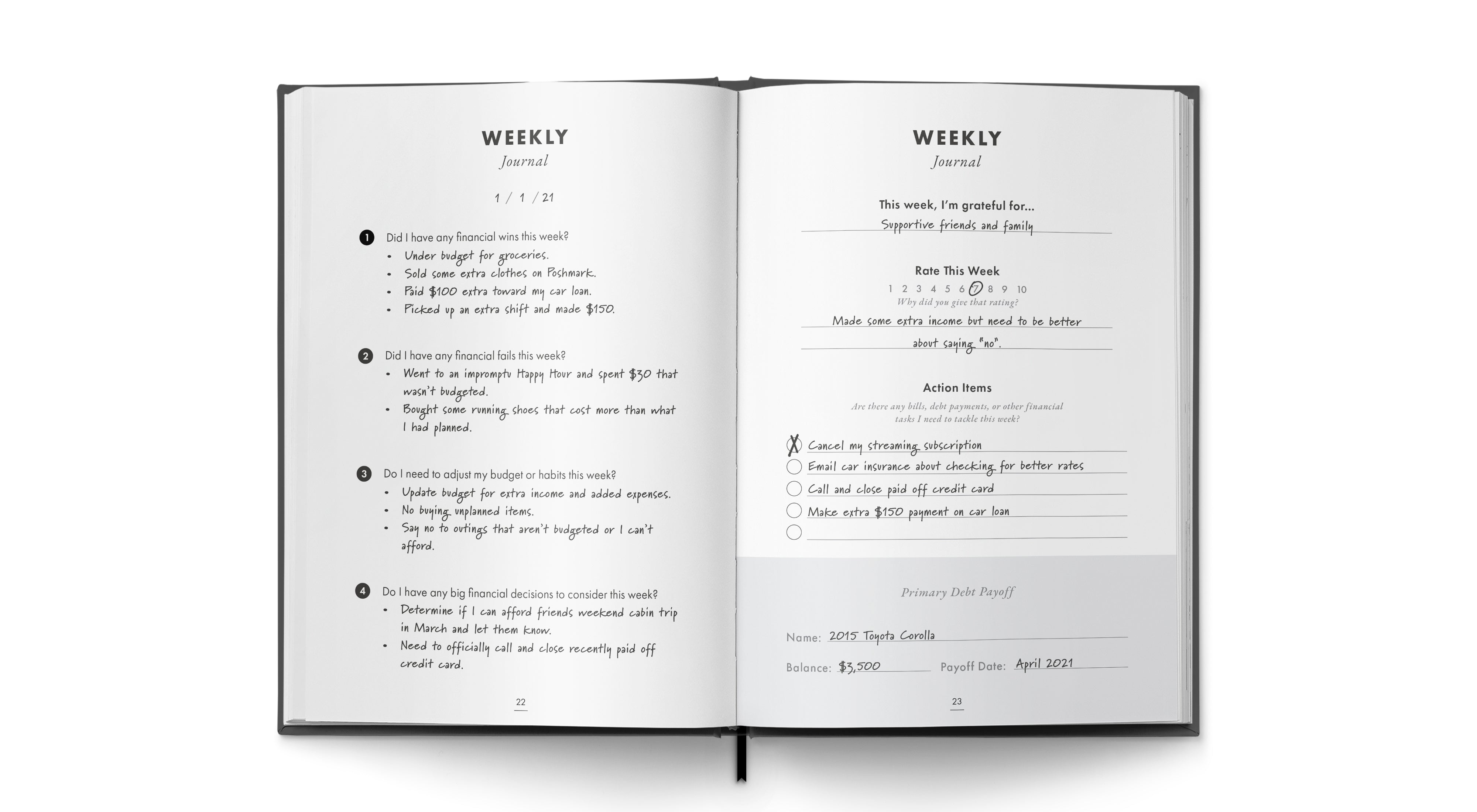

Weekly Journal - Each week, you will check in to answer a few questions, assess how your week went, refocus on your current debt payoff goal and build a plan for the following week. This weekly journal will help build a rhythm of accountability to your budget and toward systematically reaching each debt payoff. It will also instill the discipline necessary to help you reach your goal of becoming Debt Free.

Monthly Review - At the end of each month you will take a moment to pause and reflect on your progress. Start by reading a principle that will help guide you on your Debt Free Journey, then assess and reset your budget, and finish by reviewing your progress for the month.

Quarterly Check-In - Add up how much you’ve paid toward your Debt so far and visually track the progress you’ve made.

Year in Review - Recap what debts you’ve paid off, update your Net Worth, calculate how much you’ve paid toward debt in total and determine how close you are to becoming Debt Free.

Choose options

HOW TO USE DEBT FREE JOURNAL

STEP 1

Establish your starting point

You will begin by discovering where you are starting from financially. For many people, this exercise will provide the clearest financial picture they have ever had in their life.

STEP 2

BUILD A PLAN TO BECOME DEBT FREE

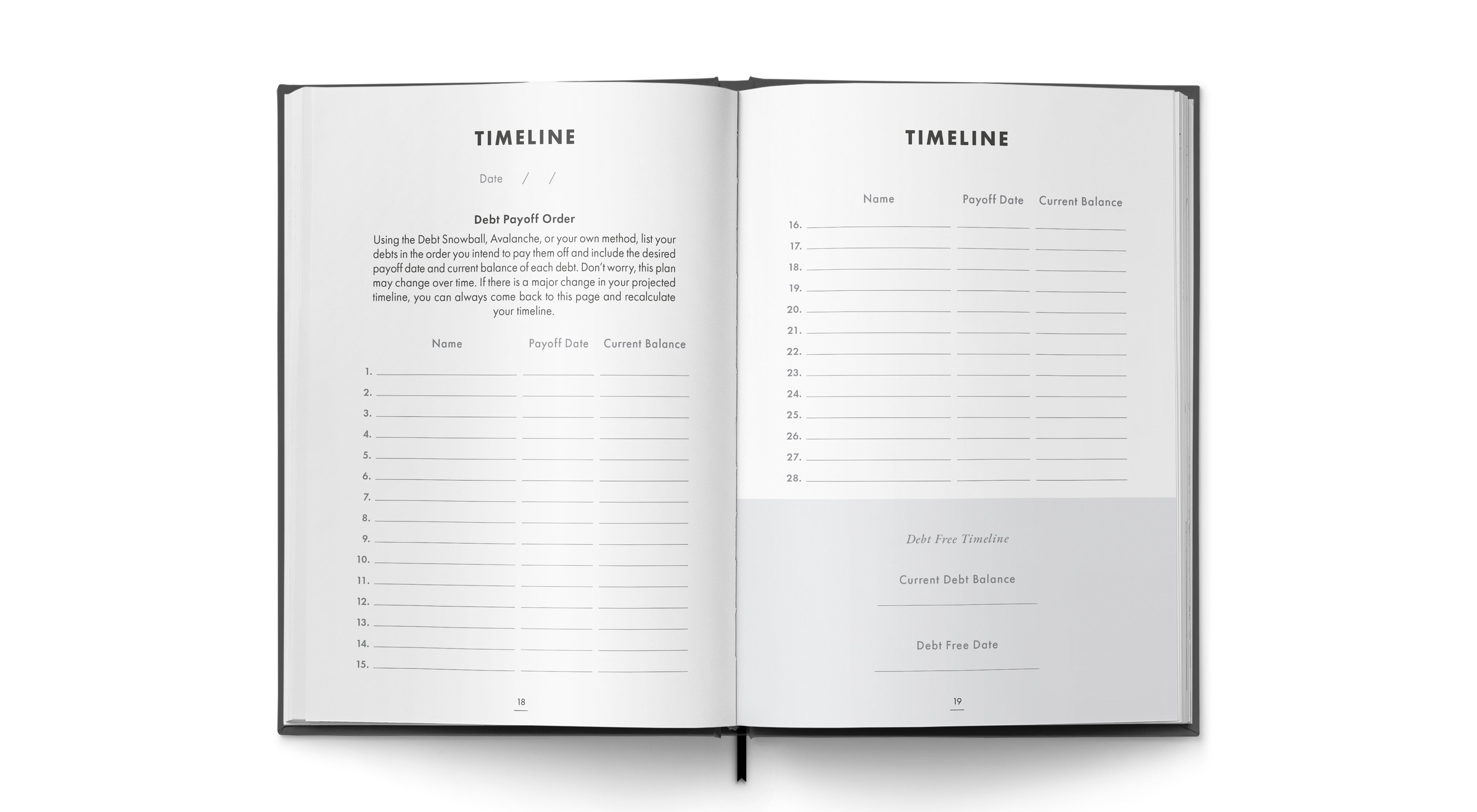

After understanding the debts you currently have, you will establish your emergency fund and build your debt-payoff timeline. This will create momentum as you focus your efforts toward paying off each debt, one-by-one.

STEP 3

A WEEKLY RHYTHM WITH YOUR MONEY

As you go through each week, you will pause to reflect, acknowledge what’s going well, and decide what tweaks are necessary to keep you on track. This process will help you feel more in control over your financial life on your journey to becoming Debt Free.

STEP 4

Track Your Progress

As you work through each week and complete the monthly reviews along the way, you will build an archive of progress along your Debt Free Journey. There are moments to pause, assess and celebrate how far you’ve come on your journey; that will solidify your progress and keep you on track to become debt free.

Blog posts

Debt Payoff Timeline: determining when you will become Debt Free

Debt Payoff Timeline Calculator: determining when you will become Debt Free

Read more